This month, we unveiled Passthrough's latest solution to help ERAs and RIAs navigate the upcoming SEC and FinCEN anti-money laundering regulations taking effect on January 1, 2026.

We’ll dive into the details of this offering shortly, but don’t miss the exciting updates we’ve made across our compliance and subscription document products.

There are seven requirements, which we’ve detailed in

this post and

this webinar with a former SEC director. If you’re working with Passthrough on KYC/AML, we already solve one of these requirements for you. The new offering solves for the rest.

Passthrough will do the following (all of which are necessary to meet the new requirements):

1. Be your AML Compliance Officer and run your day-to-day AML operations

2. Work to update your policies & procedures so that the proper controls are in place

3. Provide on-demand training to your entire team

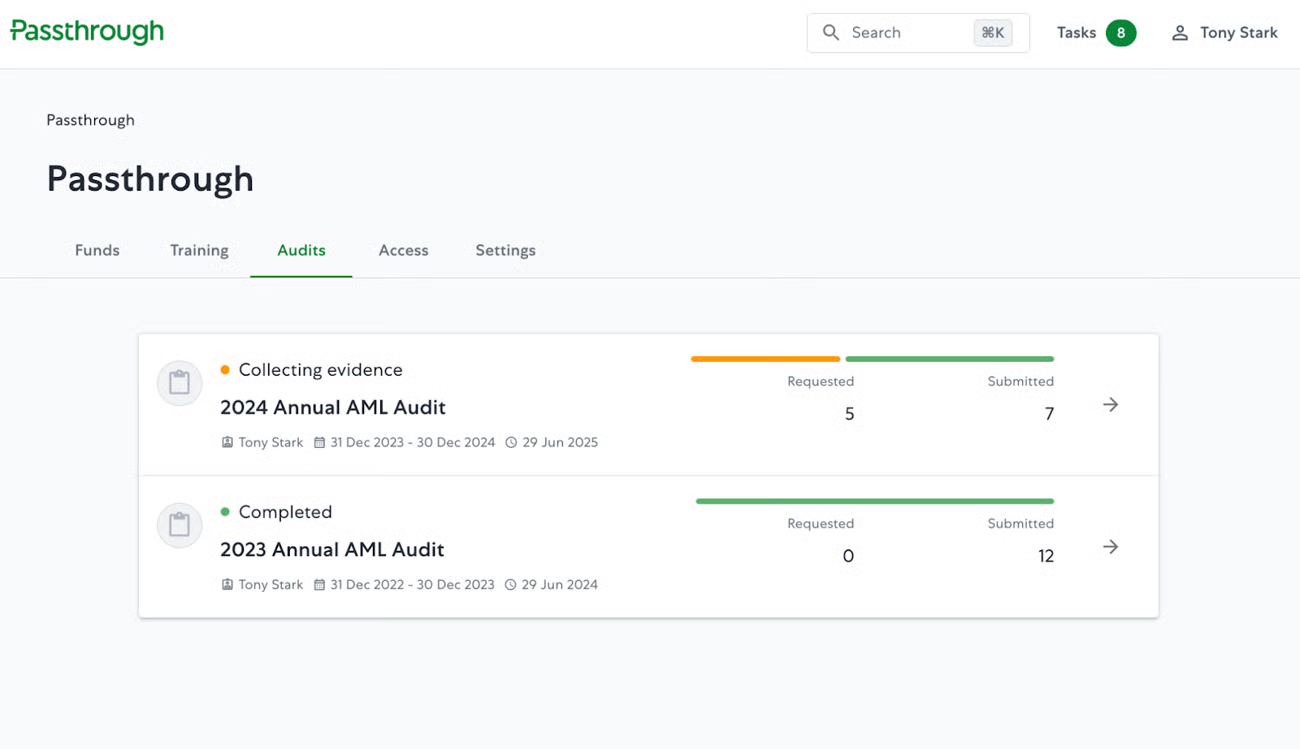

4. Perform an annual audit of the program’s effectiveness through an independent function

5. Perform KYC/AML screening on all of your investors (our existing offering)

6. Register you with FinCEN, submit suspicious activity reports as applicable, and work with law enforcement on any investigations

7. Monitor source of wealth and source of funds to make sure there’s no illicit activity

Passthrough streamlines subscription documents and KYC so you can focus on running your fund, not managing paperwork. With the new AML regs, it’s going to take a lot of work to get and stay compliant. We make it easier than cobbling together multiple solutions driven by service instead of software.

1. We have the easiest way to collect KYC/AML information available

2. With 50K+ LPs on the platform, many of your LPs will be able to reuse the information they’ve supplied elsewhere

3. Our system can enforce the required controls so you’re not worried about manual processes

4. All of this means we can offer this in a package that’s more affordable than the market

You can find out more about it in this

post or our

product page.

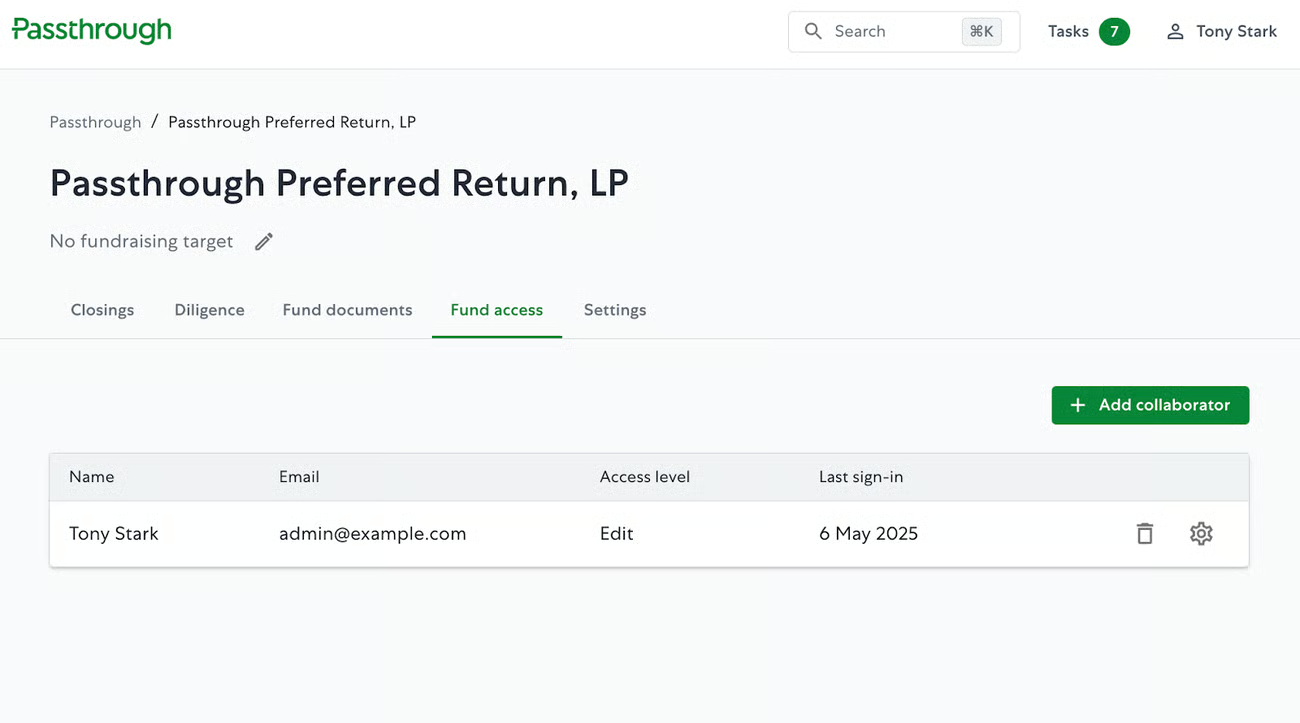

Reply to this email if you’d like to have a discussion with our Head of Financial Crime about how these rules apply to you.When investigating an investor or beneficial owner flagged with elevated risk, standard screenings for sanctions, political exposure, or fitness and probity may not be enough. We’ve had adverse media available as a tool to our team internally but we’ve exposed it to self-service users as well. This feature can be enabled at the fund level or for specific beneficial owners.

.png)

.png)